- NTI

What You Need To Know About The Fuel Tax Credit Changes

The rules governing fuel tax credits (FTC) have changed considerably over past six months and operators need to ensure they’re fully compliant ahead of heightened compliance and audit activity from the Australian Tax Office (ATO).

Key Takeaways

- The Fuel Tax Credits (FTC) for on-road heavy vehicles was cut to zero from March 30 to September 28

- The FTC for off-road heavy vehicles and auxiliary equipment was reduced to 22.1cpl from March 30 to September 28

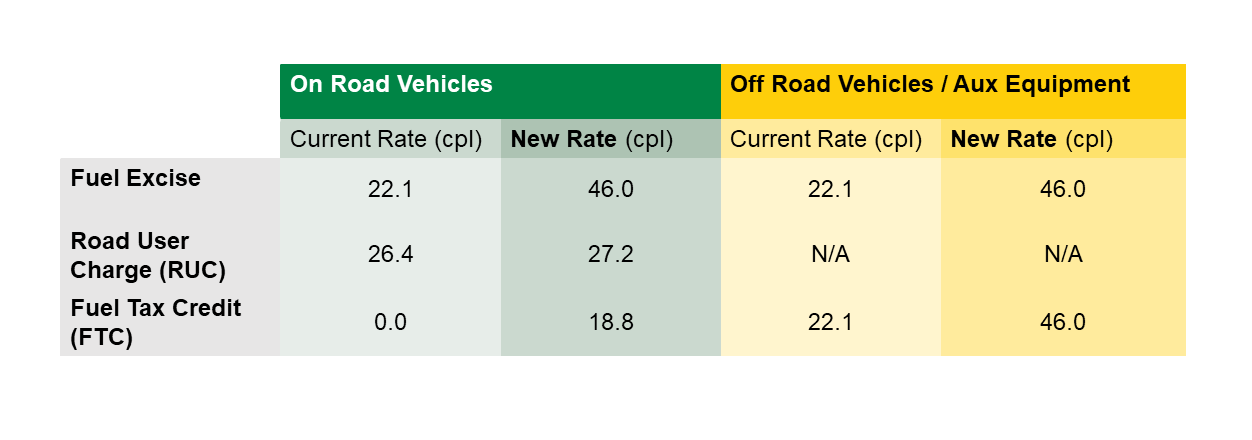

- New FTC rates of 18.8cpl (on-road) and 46cpl (off-road) apply effective 12:01am September 29

- Fuel held in stock – either in on-site tanks or in trucks – before midnight on September 28 is eligible for zero FTC

- Operators have been urged to complete a “fuel tank dip” on the night of September 28

- Operators should also complete a review of their FTC claims during the past six months to ensure no errors occurred

FTC Changes: What You Need To Know

In the March Federal Budget, the former Coalition Government cut the fuel excise of 44.2 cents per litre (cpl) by half to 22.1 cpl for a period of six months from March 30 to September 28 to address soaring cost-of-living pressures.

This reduced the fuel tax credit (FTC) on-road heavy vehicle operators (>4.5-tonne GVM) could claim – that is, the difference between the fuel excise and the road user charge (RUC) – to zero for the period (as the 26.4cpl RUC exceeded the lower fuel excise rate of 22.1cpl).

Notably, all other business uses – including operators of off-road heavy vehicles and auxiliary equipment (refrigeration, PTO’s, side loaders, diesel forklifts, diesel truck washes, yard tugs, excavators and loaders etc) – were able to claim the full 22.1cpl excise during the six-month pause (as they do not pay the RUC).

The change to the FTC was the “biggest change since the fuel tax credit was introduced in 2006” and “created a lot of hardship” for operators, Chris Sant, Principal and Fuel Tax Leader at global tax services firm Ryan, told a recent Natroad webinar.

“It was a change with little or no warning, and it had an immediate effect on operators’ financials and tax on their businesses,” he says.

While the new Federal Government recently announced the end of the fuel excise reduction from September 29 with a new rate of 46cpl applying from 12:01am on September 29, and the reinstatement of the FTC, it comes with a catch – an increase in the road user charge to 27.2cpl.

This unexpected change effectively reduces the FTC for on-road heavy vehicle operators to 18.8cpl rather than the 19.6cpl it would have been had the RUC not been increased.

Conversely, operators of off-road heavy vehicles and auxiliary equipment can claim the full 46cpl fuel excise from September 29 – up from 44.2cpl previously.

The Implications: What You Need To Do Now

Sant says on-road heavy vehicle operators need to be especially vigilant to ensure the accuracy of their claims, both in the period March 30 to September 28 as well as the transition period of September 28-29.

He reveals the ATO has already emailed his firm as well as Natroad raising concerns about potential over-claims, especially on fuel held in stock (either in fuel storage tanks or in trucks) before midnight on September 28.

Sant says fuel held in stock on the night of September 28 should still be claimed at the reduced FTC rate – that is, zero for on-road operators and 22.1cpl for operators of off-road heavy vehicles and auxiliary equipment.

“The Tax Office has already advised they are aware of potential over-claims as a result of these changes … and have made it very clear that they will enforce these changes on old fuel,” he says.

“Taxpayers should expect targeted compliance and audit activity in relation to this, particularly around fuel held in stock as at 28 September.”

Sant advises companies to complete a “fuel tank dip” on the night of September 28 and then claim all fuel subsequently acquired after September 29 onwards at the new rate.

He adds that from a “practical point of view” most operators with on-site fuel tanks will apply the new rates on fuel acquired from October 1 – and “will get near or thereabouts with that approach”.

Sant also urges operators to complete a review of their FTC claims as soon as possible to ensure no errors occurred during the past six months.

He says that in his experience many operators were unaware they could claim a 21.1cpl FTC for off-road heavy vehicles and auxiliary equipment in the March 30-September 28 period.

And he issues a further warning: operators that did not change their FTC processes when required in March to factor in the rate changes “will be obvious to the ATO”.

“If you’re claim is the same for calendar year 2022 that will set off a red flag for the ATO. It should have dropped 80 to 100 per cent over the previous period,” he advises.

“If you claimed nothing over the past six months you’ve probably understated your claim (especially as fuel in bulk tanks as at March 30 was eligible for the old FTC rates). It’s time to correct that by looking at FTC over the past six months and making any necessary corrections.”

Further Advice: What You Need To Do In Future

Sant suggests operators should take the opportunity to review their FTC claims over the past four years.

“Now is also a great opportunity to complete a review of your FTC processes, you can go back four years to reclaim any under-claimed FTCs,” he says.

Conversely, operators with annual turnover greater than $20 million can correct previous mistakes going back 12 months on their current BAS; while smaller operators can go back 18 months, Sant notes.

Large amendments may need to be addressed in annual tax returns or in extreme cases requesting approval from the Tax Commissioner. Any long than 18 months, large penalties and interest may apply, he adds.

Beyond the immediate changes, Sant says the changes have highlighted the vulnerability of operators without fuel levies in place.

“You’ve got a real opportunity to ensure you have a fuel levy in place and one that works with the changes to the FTL,” he says.

“In our experience many operators didn’t have a fuel levy in place to deal with these changes.”

This is especially important given there’s unlikely to be any respite from higher fuel prices in the immediate future, Sant predicts.

The Australian Competition and Consumer Commission (ACCC) recently stated that it anticipates fuel increases of 25.3cpl post-September 28 once current fuel stocks are replenished (https://www.accc.gov.au/consumers/petrol-diesel-lpg/monitoring-fuel-prices-following-the-excise-cut).

“I expect to see fuel prices shoot up overnight by at least 22.1cpl,” he says.

FTC Rates Pre- and Post 12:01AM September 29, 2022

Source: Ryan

Source: Ryan